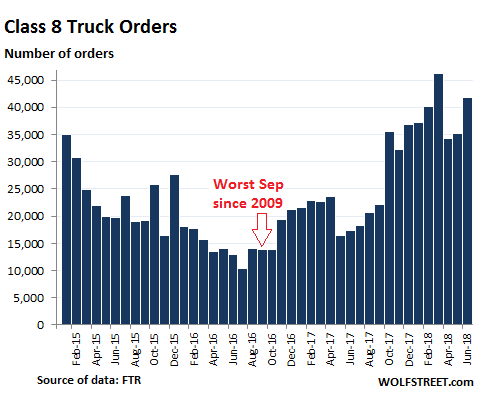

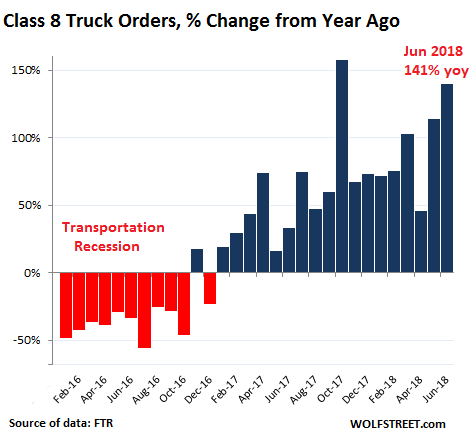

Orders for heavy trucks that haul trailers loaded with anything from junk food to oil-field equipment across the US skyrocketed 141% in June compared to a year ago, to 41,800 orders, making it the highest June ever recorded, according to transportation data provider FTR.

For the first six months this year, order volume of Class 8 trucks surged nearly 90% from a year ago to a phenomenal 235,050 units.

Class 8 truck orders in units also show that orders are seasonal. Month-to-month declines in orders starting in March and June is typically a weak month, but not this year.

FTR points out how the complexity of rising orders and subsequent delays getting orders filled leads to even more orders and even more significant delays – which is part of the boom-and-bust cycle of the industry.

“There is an enormous demand for trucks due to burgeoning freight growth and extremely tight industry capacity. However, supply is severely constrained because OEM suppliers cannot provide the needed parts and components required to build more trucks fast enough. This bottleneck is causing fleets to get more orders in the backlog in hopes of getting more trucks as soon as they are available.”

The boom in shipments that trucking companies are trying to respond to has been enormous. Soaring freight rates, higher diesel prices, and blistering shipping volume pushed transportation spending by shippers up by 17.3% in May from a year ago, the 8th double-digit year-over-year increase in a row (Cass Freight Index). The Cass Truckload Linehaul Index, which tracks per-mile full-truckload pricing but does not include fuel or fuel surcharges, jumped 9.0% in May, the most significant year-over-year increase in the data going back to 2005.

This increase reflected in the FTR Shippers Conditions Index(SCI), which covers four conditions that impact shippers using trucks and rail: freight demand, freight rates, fleet capacity, and fuel price. The SCI has been solidly negative since the end of the Transportation Recession and has deteriorated sharply over the past nine months. The April index dropped to -13.4, “signifying that there has not been capacity or rate relief for shippers in the current strong freight environment.” The trucking industry is having a ‘capacity crisis’ – but it’s just part of the business cycle and will work itself out over time.

“April may be the base in this cycle as conditions likely will not get significantly worse for shippers over the balance of the year,” according to FTR. “Overall year-over-year rate growth is close to a near-term peak. Shippers could see some stabilization in 2019 as more capacity comes on line.”

“Shippers facing significant increases in rates for truck and rail intermodal movements have not yet seen relief,” said Todd Tranausky, Senior Transportation Analyst at FTR. “However, record truck orders should begin hitting the market in the second half of the year, and we are closely watching the driver situation, which will determine if shippers see improvements as the trucks become available.”

Recent Comments